Can Kindle Succeed Without Exclusive Licensing and Distribution Deals?

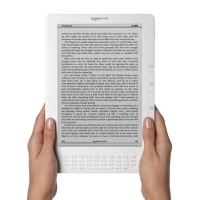

It will be interesting to see if Amazon can succeed with the expensive ($489) new Kindle DX without negotiating exclusive licensing and distribution deals that lock in and control distribution of different ebooks in selected vertical markets.

By making special arrangements with key publishers and customers, the Kindle could become the de facto primary distribution platform for certain types of DRM-enabled publications such as textbooks that are increasingly expensive to produce and distribute as “dead tree” editions.

Universities are ideal places to experiment. They can subsidize the volume purchasing of many Kindles and pass the savings on to the students.

This is a standard process. Universities have had special deals for computer software and hardware for years. If you’ve ever compared what a college kid pays for Microsoft Office at the campus book store with what you and I have to pay, you’ll see what I mean.

Figuring out what business models make the most sense for the Kindle will be next to impossible without Amazon and publishers opening up on real cost data. But I don’t see that happening anytime soon. Publishers are traditionally opaque when it comes to per title publishing and distribution costs. Just look at the long-winded discussions that occur online whenever traditional versus ebook economics and pricing are the topic.

A good recent example is The Kindle and Questioning the Economics of eBook Publishing…the Conversation Continues. Everyone in that post’s discussion thread has different numbers and examples. This is typical. It’s impossible for an outsider to really get a good picture of what the best pricing approach is. Each “book” represents a unique product with a limit to how similar it can be viewed to other products and markets. Add the confusion caused by the game-changing Kindle and it’s understandable why such discussions often generate more heat than light.

For me, the following are some of the most complex “bottom line” issues that make general discussions of e-book pricing so difficult:

- Editorial, design, creative and other per-title “fixed costs” are going to occur whether or not publishers distribute via paper or electronically. Either customer has to pay or someone to subsidize the process is located.

- It’s not always true that reducing the price of a specialized good will increase sales. Some vertical markets are so specialized that upper limits on per title demand kick in quickly. Even with e-book distribution costs driven low, someone still has to pay for the up front creation and other publication costs.

- There’s a limit to how much subsidies to individual parts of the publishing process can be relied upon to reduce the costs incurred by publishers. While the universities experimenting with Kindles are to be applauded, will they be passing the full price of $489 Kindles on to their students given they already have to purchase new computers every few years?

- Trade press economics are different from textbook economics (e.g., see Why Ebooks Must Fail).

So I don’t think that anyone really knows what the markets and economics for Kindle and e-books will look like in 12 months, especially since the price of the Kindle is so close what a usable notebook computer (or netbook) costs.

I personally believe that the Kindle is a great product. But I’m not ready to run out and buy one just yet. I still enjoy “traditional” web publishing, newspapers, and printed books very much. And I’m a heavy user of my local public library where I regularly borrow books to expand my knowledge that I would never dream of purchasing on my own.

But eventually I believe that something like the Kindle will triumph. I just hope that its short term success does not translate to an increasing “balkanization” of publishing where only the well to do — or heavily subsidized — can afford subscriptions to newspapers and specialized publications.

Copyright (c) 2009 by Dennis D. McDonald, Ph.D.